Application

Advanced Sensors in Finance Sector Security

Explore various applications of advanced sensors in the financial sector, highlighting their importance in safeguarding data and enhancing security measures.

In the rapidly evolving financial sector, the protection and secure access to sensitive data is critical. Advanced sensor technologies play a fundamental role in protecting the safety and integrity of this data. Detection of environmental hazards such as fire, temperature fluctuations, and humidity, along with access control, require real-time monitoring to alert stakeholders of security threats. In an era where financial operations are increasingly digital and interconnected, the role of these sensors becomes even more crucial.

Environmental Monitoring

Environmental monitoring is essential for protecting financial data from loss or corruption. Financial institutions may utilize the following sensors to protect data from natural threats:

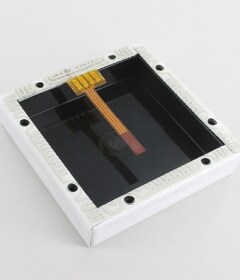

- To keep data safe and secure, financial institutions monitor the temperature critical areas such as data centers to help prevent overheating and confirm equipment operates within specified parameters.

- Institutions use humidity sensors to guard against moisture related damage to electronic equipment that holds secure data.

- Unusual vibrations may indicate malfunction of equipment in data centers or tampering. Vibration sensors are used to monitor secure equipment.

Access Control & Intrusion Detection

Access control and intrusion detection is vital for maintaining the security of financial institutions, using a variety of sensors to monitor and protect sensitive areas. Key technologies that institutions depend on to keep their data secure can include:

- Tamper detection sensors identify and alert security personnel when unauthorized access is attempted. Security systems may use cryptographic techniques to monitor changes to software or firmware confirming data integrity.

- Video surveillance systems include motion sensors to detect motion within the camera’s field of view. Once triggered, the image sensors immediately record movement and may trigger an alert depending on the sensitivity of the area being monitored.

- For building security, position sensors can detect if an access point, such as a door or window, is open or closed. If a door is opened unexpectedly or left open, the sensor triggers an alert. Parking lot gates and rising bollards use position sensors to confirm they are locked in the correct position. In high security areas, these sensors monitor the movement of turnstiles and barriers to confirm they operate correctly and securely.

- Vibration sensors can monitor doors and windows to detect attempts to force them open, triggering alarms to alert security personnel. Attempts to climb or penetrate fences, walls or other perimeter structures allowing early detection of intruders potentially triggering video surveillance. These sensors can detect drilling, cutting, glass breaking or other vibrations indicating unauthorized access.

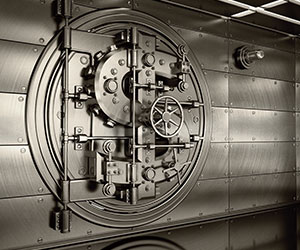

- Movement in secure areas such as vaults, server rooms, and offices can be detected using motion sensors. Motion sensors can detect suspicious activity around ATMs such as tampering or unauthorized access attempts. These sensors can monitor secure spaces in financial institutions confirming that secure areas are not left unattended.

- Changes in pressure within a secure vault or safe can indicate forced entry or other security breaches. Pressure sensors can detect these changes, triggering a security alarm that prompts further investigation.

Advanced sensor technologies have become indispensable in the financial sector, providing robust solutions for environmental monitoring and access control. By leveraging these sensors, financial institutions can actively detect and mitigate risks, confirming the safety of both data and personnel. As technology continues to advance, the integration of sophisticated sensors will continue to be critical in maintaining secure and resilient financial operations. Ongoing development and implementation of these technologies will help financial institutions stay ahead of potential threats, promoting a secure and trustworthy environment for clients and stakeholders.